“There are only two things certain in life: death and taxes”. It is a common idiom highlighting the inevitable nature of both events.

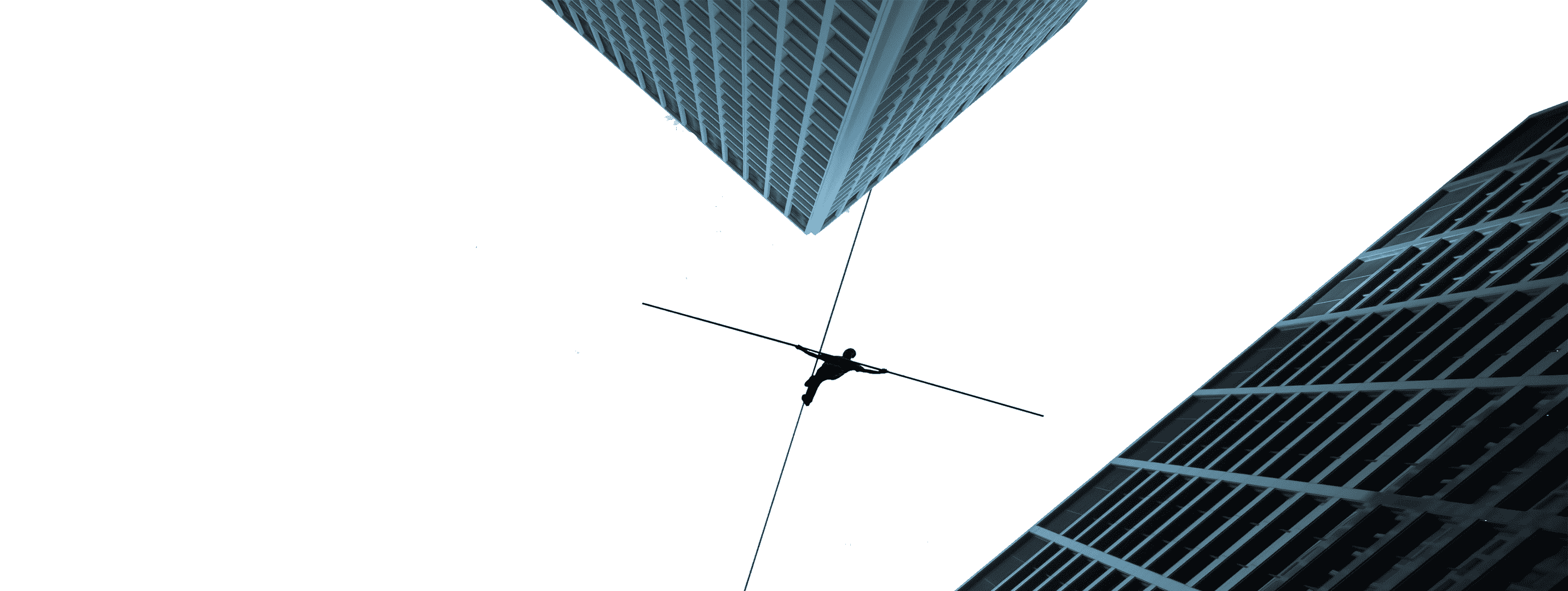

Taxes are a fact of life, but for businesses, they can feel like a risky tightrope walk. Striking the right balance between fueling growth and meeting tax obligations is crucial for both large corporations and small startups. we will explore how taxation impacts businesses of all sizes and how strategic planning can help them navigate this complex landscape.

Big Burdens, Big Opportunities: Large corporations, with their large resources, often face substantial tax bills. However, they also have the advantage of dedicated tax departments and access to sophisticated tax planning strategies. These strategies, while sometimes controversial, can help them optimize their tax burden and reinvest profits back into the business for growth. Additionally, large corporations may benefit from tax breaks for research and development or investing in certain geographic areas.

The Startup Squeeze: Small businesses, on the other hand, often feel the squeeze of taxes more acutely. Limited resources can make it challenging to afford dedicated tax professionals. Additionally, the complexities of tax regulations can be overwhelming for a small business owner navigating them for the first time. However, there are bright spots! Many countries offer tax breaks and incentives specifically for startups to encourage entrepreneurship and job creation. Understanding these benefits and taking advantage of simplified tax filing procedures for small businesses can ease the burden.

The Planning Advantage: Regardless of size, all businesses benefit from proactive tax planning. This involves analyzing the tax implications of business decisions upfront, such as choosing the right business structure (sole proprietorship, LLC, etc.) or exploring tax-advantaged retirement plans for employees. Consulting with a qualified tax advisor can be invaluable for both large and small businesses. These professionals can help navigate the complexities of tax codes, identify potential deductions and credits, and ensure businesses are compliant with all regulations.

Beyond the Numbers: Taxes are not just about revenue collection. Tax policies can also be used to incentivize specific behaviors or industries. For example, tax breaks for clean energy initiatives can promote environmental sustainability. Understanding these broader objectives can help businesses not only manage their tax burden but also align their activities with government priorities.

In conclusion, taxation is an undeniable reality for businesses of all sizes. However, with knowledge, planning, and the right guidance, businesses can navigate the complexities of tax codes and leverage them to their advantage. By striking the right balance between growth and tax obligations, businesses can ensure long-term financial stability and contribute to a thriving economy.