Gold has always occupied a special place in the global economy. It doesn’t generate income, and it isn’t issued by any government, yet it continues to be one of the world’s most trusted assets. In recent years, Gold has undergone a historic repricing since 2020, rising more than 130% into 2025 and setting successive record highs above $4,300/oz before consolidating near the $4,000–$4,200/oz area in late 2025 and early 2026. The rally reflects a rare alignment of macro forces: surging official‑sector (central bank) demand, persistent geopolitical risk, falling real yields, and a structurally weaker dollar, factors that have jointly re‑established gold as a core reserve and portfolio asset[1]. Gold has regained importance as countries, investors, and central banks look for stability in an increasingly uncertain world.

Gold and silver experienced a sudden and dramatic fall after reaching record highs earlier as the last week of January 2026. Gold dropped 15% from about $5,600 to around $4,770 per ounce, and silver fell by 31%, marking its steepest percentage decline since 1980. The plunge in gold and silver prices stemmed from a rapid correction after record highs, heightened market volatility triggered by reports of Kevin Warsh’s potential appointment as U.S. Federal Reserve chair, profit‑taking by investors, and broader uncertainty tied to geopolitical tensions, a weakening U.S. dollar, and concerns over future Federal Reserve independence[2].

Why Gold Emerged Again After 2020

Gold price fluctuations over the past decade, and especially from 2020 onward, cannot be understood through traditional supply-and-demand analysis alone.

The COVID‑19 pandemic, rising inflation, global conflicts, and fast‑changing political decisions have all contributed to major shifts in the world economy. These pressures made investors increasingly skeptical about the stability of traditional currencies. As a result, gold once again became a “safe haven”, a place to store value when everything else seems risky.

Between 2020 and 2026, gold experienced one of the most significant repricing episodes in modern financial history, its prices rose by more than 130%, reaching multiple all‑time highs[3].

This dramatic increase was not only due to regular supply‑and‑demand changes. Instead, it reflected deeper changes in global politics and finance, such as sanctions, shifting alliances, and the weakening trust in international financial systems.

A Structural Shift, Not a Temporary Spike

Gold’s rise after 2020 was driven by long‑term global changes. During the pandemic, governments issued massive stimulus packages and central banks lowered interest rates. These policies weakened confidence in major currencies and pushed investors toward gold.

Historically, gold prices rose during wars or crises. Today, however, geopolitical tensions are not temporary, they have become part of the global landscape. Trade conflicts, sanctions, financial weaponization, and political fragmentation have made gold more attractive than ever because it is politically neutral; free from counterparty risk; and highly liquid worldwide.

This means gold now has a built‑in support level, keeping prices high even during relatively calm periods.

A major turning point came in 2022 during the Russia–Ukraine conflict. When several countries froze Russia’s foreign currency reserves, it sent a strong message: Even a country’s official reserves can become inaccessible for political reasons.

This war in Europe, together with rising tensions across the Middle East and Asia, has sharply increased global geopolitical risk. At the same time, governments have expanded their use of financial sanctions, making many countries and investors more cautious about relying solely on assets tied to any one political system[4].

Gold is particularly sensitive to trade‑war dynamics, as highlighted in the 19 January 2026 GOLD.co.uk report detailing President Trump’s latest tariff threats of 10%–25% on European nations. These threats immediately sent gold as well as silver to new record highs[5]. The same GOLD.co.uk report notes that trade‑war tension weighs heavily on the U.S. dollar, which in turn boosts gold. When the dollar declines, gold becomes more affordable globally and thus more attractive to international investors.

These pressures have accelerated a shift toward “outside money,” such as gold, assets that do not depend on a single government’s liabilities and are seen as safer during uncertainty. This trend grew even stronger in 2025, when new tariff threats and global trade friction added further instability, pushing investors to seek refuge in traditional safe‑haven assets. As a result, demand for gold reached modern record highs[6].

This forced many central banks to rethink where they store their wealth. Because gold cannot be sanctioned or frozen, it became the preferred alternative. Since 2022, central banks have been net buyers of more than 1,000 tonnes a year, roughly twice the 2015–2019 pace, transforming official demand into the single most powerful, persistent tailwind for gold. Policymakers cite diversification, crisis performance, inflation hedging, and sanctions resilience as key reasons. China alone reported a 13‑month buying streak by late 2025, lifting reported reserves beyond 2,300 tonnes[7]. This led to the fastest pace of central‑bank gold buying in modern history

Gold and the U.S. Dollar: A Changing Relationship

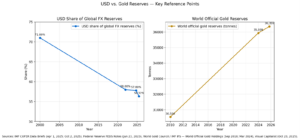

Gold traditionally moves in the opposite direction of the U.S. dollar, but geopolitical pressures have changed how this relationship works.

While the dollar is still the world’s main reserve currency, its share in global reserves has slowly declined over the past two decades. Many countries are diversifying their reserves, not into other currencies, but into gold.

This shows that gold is increasingly used as a “risk‑off complement” to the dollar rather than a replacement for it.

Impact on Other Major Currencies

- Euro: Despite expectations, the euro has not emerged as a strong alternative to the U.S. dollar, partly due to internal economic differences and external geopolitical vulnerabilities.

- Japanese Yen & Swiss Franc: These currencies act as traditional safe havens. When geopolitical tensions rise, they often strengthen alongside gold.

- Emerging‑market currencies: Gold‑producing countries may benefit from higher gold prices, but other emerging markets often suffer currency outflows during periods of global uncertainty.

BRICS, Gold, and Shifting Global Power

Several BRICS[8] countries, especially China and Russia, have increased their gold reserves significantly. Their goal is not to create a gold‑backed global currency, but to reduce dependency on the U.S. dollar and avoid potential sanctions.

Gold allows these countries to:

- Diversify their reserves

- Trade more independently

- Strengthen their financial stability

This sustained demand adds long‑term upward pressure on gold prices.

However, Chinese and Russian banks are rapidly running out of physical gold as both countries face surging domestic demand amid record‑high global gold prices. In China, major banks, including ICBC, Agricultural Bank of China, China Construction Bank, Postal Savings Bank, and Bank of China, show widespread stockouts of gold bars across most sizes, with only limited availability of smaller denominations. Analysts warn that although prices may continue to rise, risks are escalating, and investors should diversify[9].

Russia is experiencing similar pressure: its commercial and central bank gold reserves fell by 46.4% in 2024, the steepest drop since 2020, leaving national gold holdings at their lowest level since July 2022. Despite being major BRICS members with historically strong gold positions, both nations are now seeing their gold inventories drained due to runaway local demand, even as global spot prices hit fresh all‑time highs near $2,906 per ounce[10].

De‑Dollarization and the Search for Neutral Assets

A declining dollar is one of the most important drivers of the current gold rally. Many countries are not abandoning the U.S. dollar, but as a risk-management strategy, they are trying to reduce their exposure to geopolitical risk. Gold is becoming a preferred tool for this strategy because it sits outside political control.

This move toward diversification is gradually shaping a more multipolar financial system, where gold plays a stabilizing role.

Gold as a Symbol of Trust

Gold price changes from 2020 to 2026 reflect more than just market behavior, they show the world’s growing uncertainty about political stability, global governance, and economic cooperation.

The gold market continues to break historic records heading into 2026, driven by elevated geopolitical tensions, currency instability, and strong investor demand for safe‑haven assets. Multiple reports from GOLD.co.uk confirm that gold has repeatedly pushed to new highs in January, with both gold and silver benefitting from a world grappling with political and economic uncertainty.

In an era where political decisions increasingly shape financial outcomes, gold has become a neutral anchor of trust. Its price movement signal more than market sentiment, it tells a clear story:

The world is becoming more fragmented, and investors are searching for assets that may remain stable no matter what happens.

The gold market is unpredictable it is unknown how it will shape the future.

[2] The price of gold and silver has fallen sharply. Where did this plunge come from? | Euronews

2 World Bank. (2024). Commodity Markets Outlook: Precious Metals Special Focus. Washington, DC.

[4] Geopolitical Storm Brews: Gold Shines as Ultimate Safe Haven Amidst Global Instability | FinancialContent

[5] Gold news – January gold news 2026 | GOLD.co.uk

[6] Gold races to $5,100 record peak on safe-haven demand

[8] Brazil, Russia, India, China and South Africa

[9] Why A Chinese Gold Mania May Be Starting (Technical Analysis) | Seeking Alpha

[10] BRICS banks bleeding gold bars: China and Russia face runaway gold demand | Kitco News

References

- World Gold Council – Central Bank Gold Demand Reports

- International Monetary Fund (IMF) – COFER & International Financial Statistics

- World Bank – Commodity Markets Outlook

- BIS Quarterly Reviews

- Federal Reserve Economic Research (FEDS Notes)

© 2026 PA Global. All rights reserved.